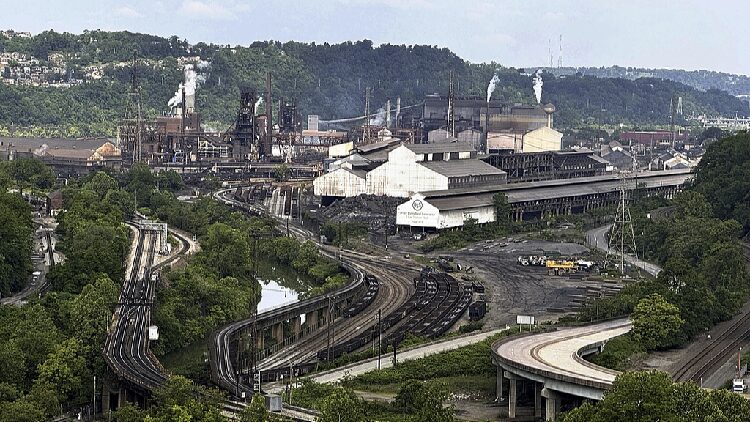

Nippon Steel’s $14.9 billion bid to acquire U.S. Steel is back on track after the Biden administration granted a crucial extension, giving the companies until June 18, 2025, to finalize the deal.

In a joint statement released on Saturday, the steel giants expressed optimism: “We are pleased that CFIUS has granted an extension… We look forward to completing the transaction, which secures the best future for the American steel industry and all our stakeholders.”

The Committee on Foreign Investment in the United States (CFIUS), an interagency panel that reviews foreign investments for national security concerns, had previously recommended blocking the merger. President Joe Biden halted the acquisition in January on these grounds.

Legal Showdown Ahead

The extension comes as Nippon Steel and U.S. Steel mount a legal challenge against the administration’s decision. They allege that the CFIUS review was biased due to Biden’s longstanding opposition to the deal, denying them a fair assessment. The companies have appealed to a federal court to overturn the president’s order, hoping for another opportunity to secure the merger.

The legal tussle highlights the complexities of international business deals, especially those scrutinized for potential national security risks. The treasury secretary, who chairs CFIUS, usually guides such decisions. In this case, however, the panel couldn’t reach a consensus, leaving the final call to the president.

Political Hurdles and Bipartisan Opposition

Opposition to the merger isn’t confined to one political party. Both Democrats and Republicans have raised concerns about a foreign entity acquiring a major American steel producer. The United Steelworkers union has also voiced objections, though representatives were unavailable for comment.

Implications for U.S.-Japan Relations

Japan’s Foreign Minister Takeshi Iwaya expressed disappointment over the initial blockage. Speaking on a public broadcaster, he emphasized the importance of the U.S.-Japan alliance. “The broader context of the Japan-U.S. alliance is extremely important, and it is essential to handle this transaction appropriately to avoid disrupting it,” Iwaya stated.

He also highlighted the potential impact on economic relations: “Japan is the largest investor in the United States. There is widespread unease within the business community, and I will continue urging the U.S. to alleviate these concerns.”

The unfolding scenario puts a spotlight on international investments and their ripple effects on global alliances. As the June 2025 deadline looms, all eyes will be on how the legal and political dynamics play out.

Reference(s):

Companies keen after U.S. delays nixing Nippon Steel-U.S. Steel merger

cgtn.com