China’s economy saw a significant surge in the fourth quarter of 2024, with the year-on-year GDP growth rate climbing to 5.4% from 4.6% in the previous quarter, surpassing market expectations. This impressive rebound was largely driven by strong expansionary policies implemented since late September, which boosted economic momentum.

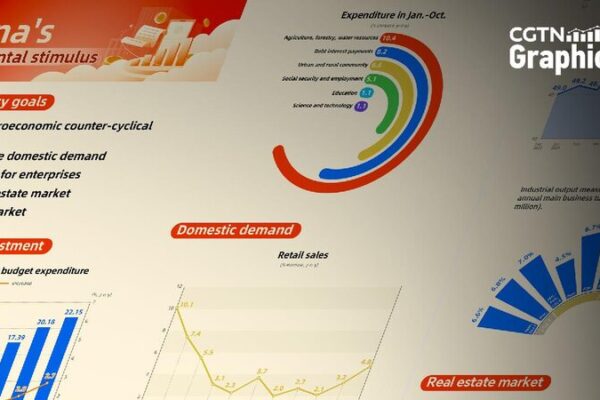

Industrial Growth and Export Boom

The industrial sector played a vital role in this upswing. In December, the year-on-year growth rate of industrial added value rose to 6.2%, exceeding forecasts. Exports were a major contributor, especially in general machinery, household appliances, and automobiles. Products like general machinery saw export growth jump to 29%, while household appliance exports grew by 14.1%. These industries not only boosted exports but also enhanced industrial production.

Consumer Spending on the Rise

December also witnessed a rise in consumer spending, with total retail sales of consumer goods increasing by 3.7% year-on-year. Key drivers included household appliances, communication equipment, and daily necessities, thanks to favorable trade-in policies encouraging consumers to upgrade their products.

Investment Trends and Real Estate

Fixed asset investment saw a slight decrease in growth, dropping to 3.2% in December from 3.3% in November. However, midstream and upstream manufacturing industries maintained strong investment levels, particularly in special equipment and metal products. On the other hand, investment in downstream industries like food and automobile manufacturing slowed down.

Real estate development investment continued to face challenges, with a year-on-year decline widening to 13.3%. Despite this, there are signs of improvement due to supportive policies, as commercial housing sales revenue grew by 2.4% in December.

Looking Ahead to 2025

For the entire year of 2024, China’s GDP growth rate reached 5%, meeting the annual target. The industrial sector was key in maintaining stability, while the service sector saw a more significant slowdown. As we move into 2025, policies aimed at stimulating consumption are expected to continue. However, potential trade tensions may impact overseas demand, so policy adjustments might be necessary.

Future economic growth may rely less on fixed asset investment due to long-term factors like demographic changes. It’s crucial to explore new growth engines by improving household income expectations, strengthening social security, and encouraging new consumption demands.

The Path Forward

China’s economic landscape is evolving, and adapting to these changes will be essential. By focusing on high-quality transformation in investment and consumption, the country aims to sustain growth and improve living standards for its people.

Reference(s):

cgtn.com