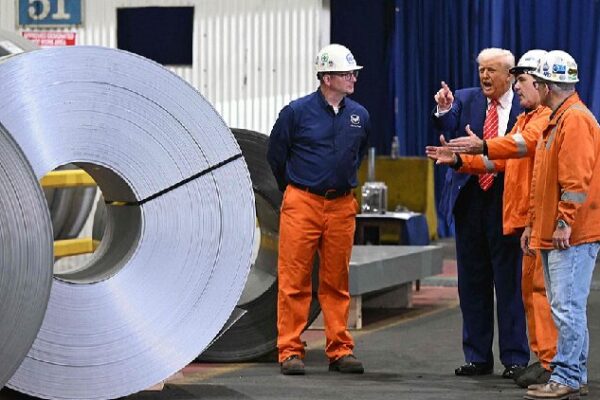

President Donald Trump has announced heightened tariffs on steel and aluminum imports, a move that has sent ripples through global markets. Speaking to steelworkers in Pennsylvania, Trump revealed plans for even steeper duties, aiming to bolster domestic production and protect U.S. industries.

The announcement comes at a time when U.S. stocks, particularly the S&P 500 and NASDAQ, have experienced their best month since early 2023. However, the introduction of new tariffs has sparked concerns about potential trade tensions and the impact on international relations.

Global Reaction

Economists and international leaders are closely watching the developments. Higher tariffs could lead to increased costs for manufacturers relying on imported materials, possibly affecting consumer prices and economic growth.

Young people and businesses in the Global South are particularly attentive to these changes, as shifts in U.S. trade policy can have far-reaching effects on emerging economies. The new tariffs might influence global supply chains, employment, and international trade dynamics.

What This Means

The decision reflects the administration’s focus on revitalizing American industries but raises questions about the future of global trade partnerships. As markets adjust to this news, the world watches to see how these tariffs will shape economic relationships and whether they will lead to retaliatory measures from other nations.

Reference(s):

cgtn.com