As the US government under President Donald Trump moves forward with new tariffs on imports, several financial institutions and international agencies are cutting their forecasts for the world’s largest economy. Analysts warn that these trade measures could dampen economic prospects both domestically and globally.

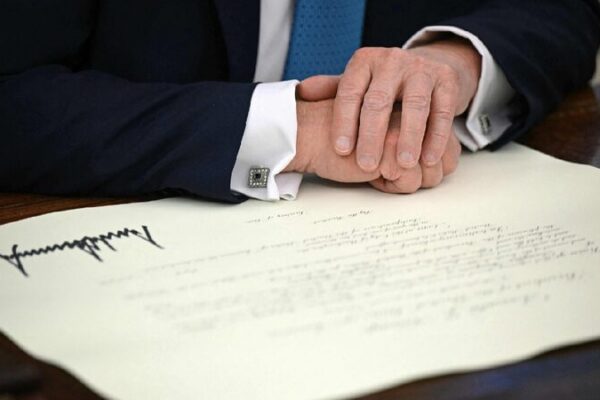

Under the banner of addressing trade imbalances and protecting domestic industries, the Trump administration has imposed tariffs on various goods and countries. The President’s approach—summed up in his own words, “We tax you what you tax us”—has raised concerns about escalating trade wars.

Financial experts caution that broadening tariffs could backfire, leading to higher prices for US consumers and potential job losses in industries reliant on global supply chains. “An outlook for slower growth suggests lower valuations on a more sustained basis,” said David Kostin, chief US equity strategist at Goldman Sachs Research, responding to reduced forecasts for the S&P 500 index.

Goldman Sachs economists have estimated a significant probability of a recession occurring within the next 12 months. Similarly, Morgan Stanley has lowered its forecasts for US economic growth, citing greater impacts from tariffs and a tight labor market contributing to higher inflation. “Earlier and broader tariffs should translate into softer growth this year,” noted Morgan Stanley economists led by Michael T. Gapen.

The Organisation for Economic Co-operation and Development (OECD) has also weighed in, suggesting that the tariffs and counter-tariffs could cause global output to decline and inflation to rise. According to their report, global output could fall by around 0.3 percent in the coming years due to these trade tensions.

The US Congressional Budget Office (CBO) echoed these concerns, stating that the economy is expected to grow more slowly in the near future. Factors such as weak population growth and increased government spending are projected to contribute to a slowdown over the next few decades.

As trade policies continue to evolve, the potential ramifications on the global economy remain a critical area of focus for analysts and policymakers alike.

Reference(s):

Forecasts for US economy slashed in run-up to Trump's 'Liberation Day'

cgtn.com