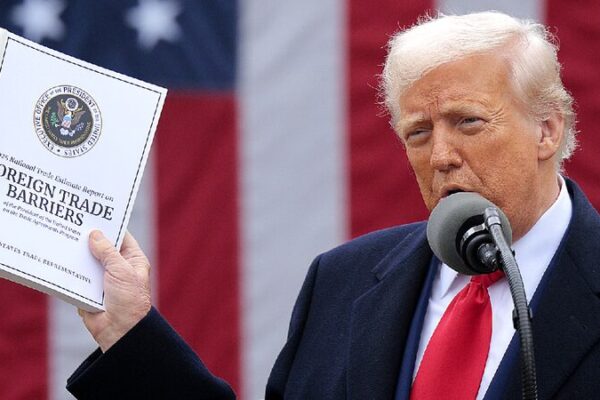

The United States’ implementation of ‘reciprocal tariffs’ has sent shockwaves through the global multilateral trading system, raising concerns about the future of international economic cooperation. The policy, which imposes tariffs based on trade deficits with other countries, is seen by many as a departure from established global trade rules.

The World Trade Organization (WTO) emphasizes the principle of most-favored-nation treatment, which prohibits member states from discriminating among their trading partners. By imposing differentiated tariffs, the US undermines this cornerstone of international trade. Critics argue that this approach distorts the true meaning of reciprocity, shifting from mutual concessions to a unilateral focus on trade balances.

Developing countries are particularly vulnerable under this policy. The increased tariffs make it harder for them to participate in global value chains, exposing their domestic industries to intensified international competition. A former state minister of Ethiopia highlighted that high US tariffs could lead to significant job losses and slow economic growth across Africa.

The root causes of the US trade deficit are complex. Factors include the offshoring of low-end manufacturing, which moved pollution-heavy and labor-intensive industries abroad, and the high consumption patterns of US residents, which drive the demand for imported goods. Additionally, the US enjoys surpluses in capital inflows due to its economic position and in services trade because of its technological advantages.

Analysts warn that the ‘reciprocal tariffs’ policy may not reduce the trade deficit but could instead harm the US economy. Consumers might face higher prices for everyday items. Research from Yale’s Budget Lab suggests that overall inflation in the US could rise by more than two percentage points by 2025, with prices for goods like leather products and coats increasing by over 15 percent. This inflation could cost each US household an extra $3,800 annually.

US manufacturers are also at risk. Higher tariffs on imported components for products such as smartphones and automobiles increase production costs, potentially making US goods less competitive internationally. The financial markets have reacted negatively, with significant fluctuations and a decline in stock market values since the policy’s introduction.

History indicates that unilateral actions that defy international norms often lead to negative outcomes. The ‘reciprocal tariffs’ not only impact the US’s global standing but also erode trust in its policies, potentially undermining economic leadership. Meanwhile, countries around the world continue to advocate for multilateralism, working together to promote global economic recovery and development.

Reference(s):

US tariff policy impacts the global multilateral trading system

cgtn.com