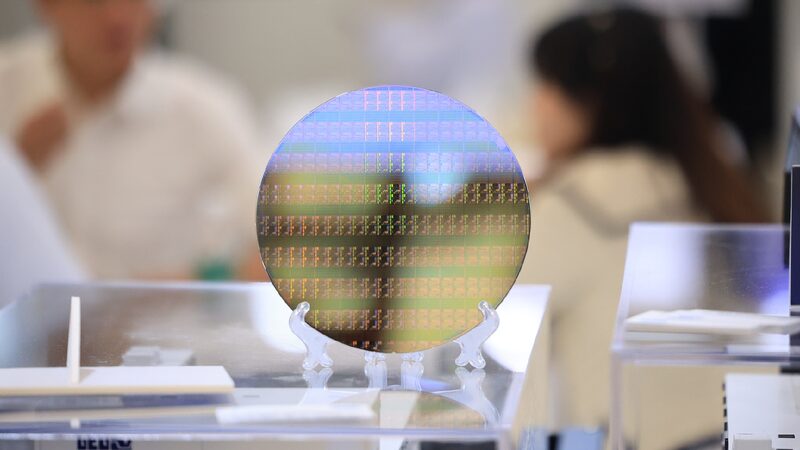

The United States is witnessing a decline in foreign investment as businesses grapple with the impact of escalating tariffs. Major companies like Taiwan Semiconductor Manufacturing Company (TSMC), the world’s leading chipmaker, have expressed concerns that the ongoing tariff disputes are jeopardizing their significant investment plans in the US.

TSMC had announced a massive $165 billion investment in Arizona, including the construction of six fabrication factories, two packaging and testing facilities, and a research and development center. However, the company has warned the US Department of Commerce that the current tariff environment could force them to reconsider or even cancel these plans. This situation mirrors the uncertainty faced by other global giants like SoftBank, Apple, and Stellantis, whose investment visions in the US have become uncertain amidst trade tensions.

In a bid to boost domestic manufacturing, former President Donald Trump imposed a 25% tariff on automobile and parts imports from around the world, aiming to encourage foreign automakers to produce within the US. Contrary to this intention, the auto industry has faced significant setbacks. Reports indicate a 20% reduction in auto industry jobs so far this year. Stellantis, a leading European automotive company, has had to temporarily lay off 900 employees across its five US factories and suspend operations in neighboring Canada and Mexico.

The ripple effects of the tariffs have led to hundreds of billions of dollars in investment projects being put on hold. Several state governments have raised concerns about investment slowdowns due to the uncertainties brought about by the tariffs. International leaders have also voiced their apprehensions. For instance, French President Emmanuel Macron reportedly urged French companies, which represent the fifth-largest foreign investment group in the US, to reconsider their investments due to the unpredictable nature of US policy decisions. Similarly, concerns have been raised from other quarters about the weakening investment climate in America.

The slowdown in investment has tangible economic indicators. Orders for core capital goods in the US fell by 1.3% in April, marking the most significant drop in six months. Analysts suggest that capital investment may continue to be postponed until there is greater clarity in policy directions.

The adverse effects of the tariff policies can be understood through several factors. Firstly, tariffs lead to higher prices for consumers, which can dampen market demand and potentially trigger economic downturns. Secondly, increased production costs make investing in the US less attractive to foreign companies. For example, the 25% tariff on steel, aluminum, and auto parts can increase the price of passenger cars by $5,000 to $10,000, pushing the average new car price upwards of $48,000. This price hike could significantly reduce demand, especially among lower-income families who accounted for about 13% of total US passenger car sales in recent years.

Thirdly, the tariffs disrupt global supply chains, introducing higher risks for businesses considering investments in the US. Companies like TSMC rely heavily on a globally integrated supply chain. Uncertainties stemming from trade disputes make such investments less feasible. Lastly, unpredictable tariff decisions create an environment where long-term planning and feasibility studies become challenging for investors. Major investments, which typically require extensive planning over several years, are hindered by such unpredictability.

While the intention behind the tariffs was to bolster domestic investment and bring manufacturing back to the US, the outcomes appear to be counterproductive. Instead of encouraging investment, the tariffs seem to be discouraging it, as companies opt to wait for a more stable environment or choose alternative locations for their investments. The complexity of global trade and the interconnectedness of modern supply chains mean that unilateral tariff measures can have unintended and far-reaching consequences.

Reference(s):

cgtn.com