China’s Economy Bounces Back with New Stimulus Measures

China’s economy is showing strong signs of recovery after the government rolled out a series of incremental stimulus policies in late September. Key sectors like real estate, consumption, investment, and industrial output are bouncing back, boosting market confidence and expectations.

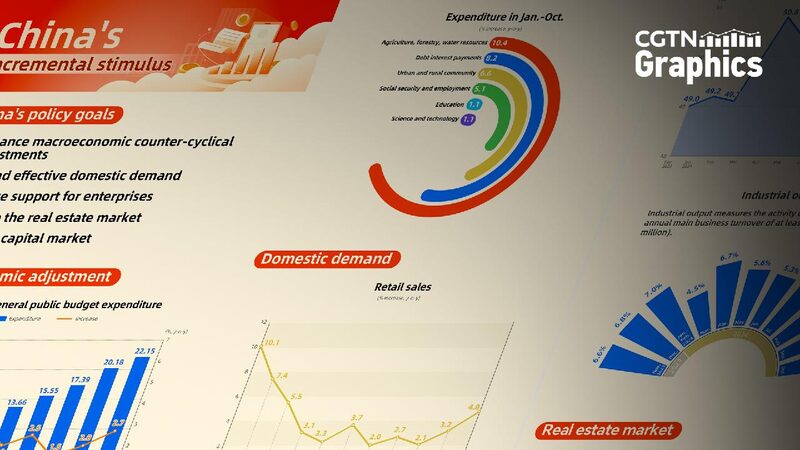

Proactive Macroeconomic Adjustments

To support major strategic initiatives and improve people’s livelihoods, China has implemented proactive fiscal policies. The government issued 1 trillion yuan (around $138 billion) in super-long-term special government bonds and increased the local government special debt limit to 3.9 trillion yuan. In the first ten months of the year, general public budget expenditure reached 22.15 trillion yuan, up 2.7% compared to the previous year, with increased spending on urban and rural communities, social security and employment, science and technology, and education.

Boosting Domestic Demand

Efforts to stimulate social investment and consumption are paying off. Retail sales began to rebound in September, with a notable 51% surge in sales of new energy passenger vehicles and a 20.5% increase in sales of household appliances and audio-visual equipment, thanks to a new trade-in policy. In October, retail sales climbed further by 4.8%, marking the highest growth rate since February.

Fixed-asset investment growth stabilized in September after months of decline. Infrastructure investment growth rose from 4.1% to 4.3% in October, the first uptick since March. Manufacturing investment, which bottomed out in August, bounced back to a 9.3% growth rate in October.

Enterprise Activities on the Rise

The manufacturing Purchasing Managers’ Index (PMI), an indicator of economic health in the manufacturing sector, stopped falling in September and returned to 50.1% in October, signaling expansion for the first time in six months. A PMI above 50% indicates growth. Industrial output, which measures activity among enterprises with significant turnovers, also rebounded in September after four months of decline.

Real Estate Market Shows Positive Growth

In October, second-hand home prices in China’s top-tier cities showed positive growth. Beijing, Shanghai, and Shenzhen experienced increases of 1%, 0.2%, and 0.7% respectively, indicating renewed confidence in the real estate market.

Capital Markets Recover

The capital market is also experiencing a significant recovery. In October, the total turnover and trading volume on the Shanghai and Shenzhen stock exchanges surged by approximately 1.5 times—the largest growth rate this year. Strong government policies have bolstered market sentiment, leading to increased activity among investors.

With these positive trends across key economic sectors, China’s incremental stimulus measures appear to be effectively stabilizing the economy and fostering growth.

Reference(s):

cgtn.com