U.S. President Donald Trump’s recent tariff hikes on steel and aluminum imports might hit American consumers harder than expected. Economists warn that these tariffs could lead to higher prices and increased tax burdens for many households.

On Monday, Trump raised tariffs on all steel and aluminum imports to 25 percent. This move follows earlier tariff increases on Canada, Mexico, and China announced on February 1. The aim is to protect American industries, but the ripple effect could mean more expensive goods for shoppers.

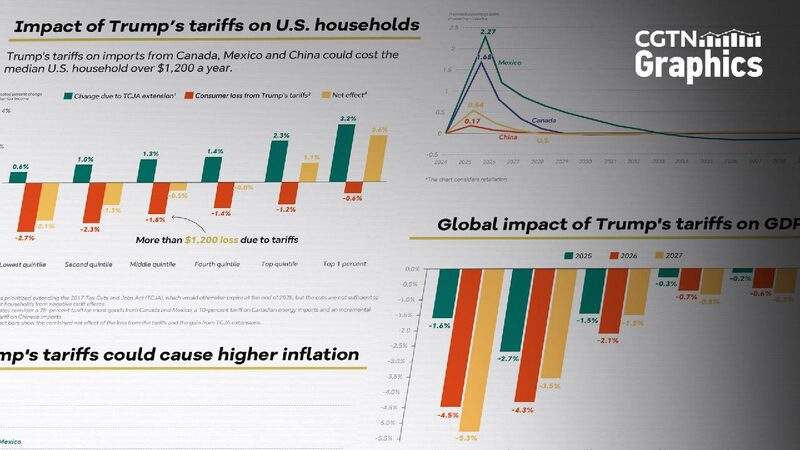

According to the Peterson Institute for International Economics (PIIE), these tariffs could cost the median U.S. household over $1,200 a year. That’s because the tariffs not only apply to raw materials but also to many everyday products produced overseas or using imported materials.

While Trump has promised tax cuts to ease the financial burden on Americans, experts believe these measures might not be enough. The 2017 Tax Cuts and Jobs Act (TCJA), which is set to expire at the end of 2025, provided some relief. However, the benefits from tax cuts may be outweighed by the increased costs due to tariffs.

The economic impact doesn’t stop there. EY-Parthenon, a global strategy consultancy, projects that these tariffs could reduce U.S. GDP by 1.5 percent by 2025. Inflation could rise by 0.4 percentage points, meaning everyday items could become more expensive. The PIIE also predicts that inflation could rise by 0.54 percentage points due to the incremental tariffs.

For American consumers, this means that the prices of cars, electronics, and even groceries could go up. The tariffs act like a tax on imports, and these costs are often passed down to consumers.

These tariff changes in the U.S. could also impact economies around the world, including those in the Global South. Countries that export to the U.S. might face reduced demand or need to adjust their own trade policies, which can affect jobs and economic growth locally.

As the global economy watches these developments, young people and families in the U.S. may need to brace themselves for tighter budgets. Understanding these economic changes is crucial, as they can affect everything from the cost of college to the price of a new smartphone.

Reference(s):

Trump's tariff tactics to stoke inflation, increase tax burden

cgtn.com