China’s Q1 Growth Surpasses Expectations with 5.4% GDP Boost

China’s economy has kicked off the year on a high note, growing by 5.4% in the first quarter of 2025, surpassing forecasts and signaling a robust recovery. The impressive growth is driven by strong retail sales, industrial production, and supportive government policies, highlighting resilience in the face of global economic challenges.

Strong Consumer Spending and Industrial Output

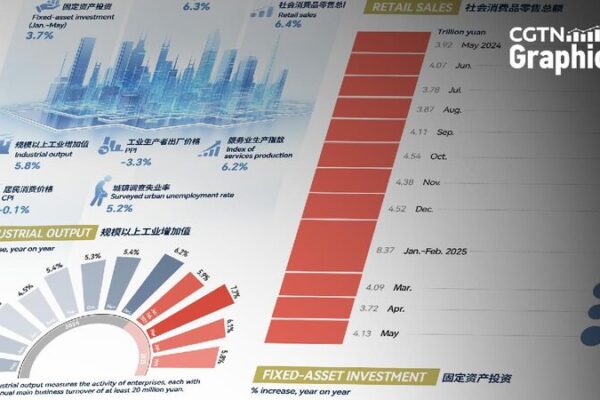

Retail sales in March surged by 5.9%, marking the fastest pace in over a year and outpacing the predicted 4.3% growth. This uptick reflects increased consumer confidence and spending power among the population. Industrial production also saw significant growth, jumping 7.7%, which indicates a resurgence in factory activities and a strengthening manufacturing sector.

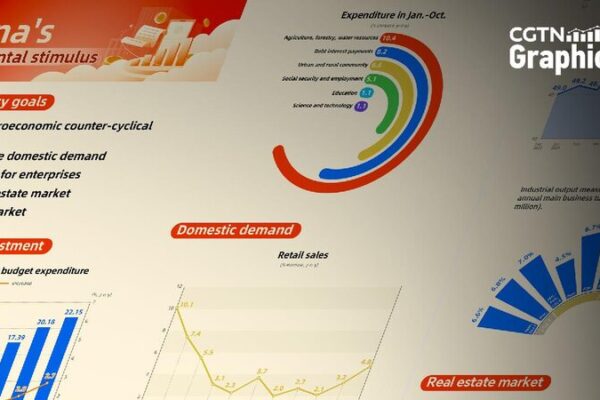

Economists see these figures as a positive sign for the world’s second-largest economy. Huang Zichun, an economist at Capital Economics, believes that continued policy support will further bolster domestic demand. “Policy support should continue to shore up domestic demand over the coming months,” she noted, highlighting the potential for expanded fiscal spending and monetary easing.

Investment and Technological Innovation Lead the Way

Fixed-asset investment, particularly in sectors outside of property, is showing signs of recovery. This aligns with double-digit growth in excavator sales and usage, suggesting that infrastructure projects are picking up steam. Xing Zhaopeng, a senior strategist at ANZ, expressed optimism about the data, stating that the growth could help close the output gap without the immediate need for monetary easing.

Chen Fengying, a research fellow at the China Institutes of Contemporary International Relations, emphasized the role of technological innovation, private sector confidence, and resilient foreign trade as key drivers of growth. These factors are contributing to a more dynamic and diversified economic landscape.

Looking Ahead Amid Global Challenges

Despite the positive momentum, some analysts remain cautious due to potential external pressures such as trade tensions. Ryota Abe, an economist at SMBC in Singapore, suggested that additional stimulus might be necessary to mitigate the impact of international trade issues. However, others like George Efstathopoulos, a portfolio manager at Fidelity International, believe that China may not require significant stimulus interventions but should remain adaptable in its policy approach.

Surprising sector-specific data also point to areas of unexpected growth. Nuclear power generation surged over 20% in March, reflecting China’s expanding commitment to alternative energy sources. Additionally, cross-border e-commerce platforms experienced gains, with companies like DHGate benefiting from viral promotions on social media platforms.

Overall, the stronger-than-expected growth in the first quarter sets a promising tone for the remainder of the year. With ongoing support from policy measures and a focus on innovation and investment, China’s economy appears poised to navigate global uncertainties and maintain its upward trajectory.

Reference(s):

China's 5.4% Q1 growth beats forecasts, analysts see resilient demand

cgtn.com