As the United States escalates its tariff measures, disrupting global trade and challenging Chinese exports, China is demonstrating resilience by harnessing its vast domestic market and forging new international partnerships.

Policy Measures Strengthen the Economy

In response to the tariff hikes, China’s leadership introduced targeted macroeconomic policies to bolster the economy. Measures such as reducing reserve requirement ratios, lowering mortgage rates, channeling long-term capital into markets, and issuing ultra-long-term special treasury bonds have been implemented.

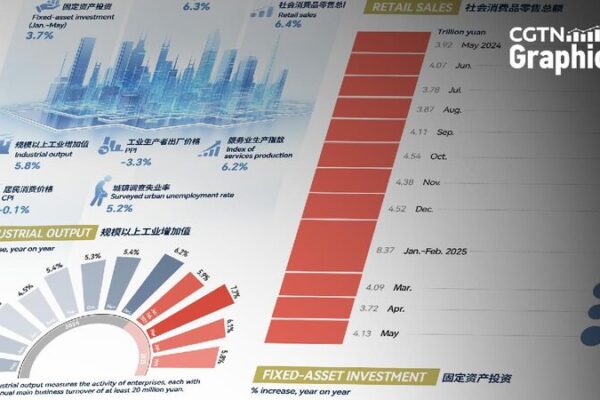

These efforts have yielded positive results. The National Bureau of Statistics reported a 4.6% increase in total retail sales year-on-year in the first quarter of 2025, surpassing the annual figure of 2024. The manufacturing Purchasing Managers’ Index (PMI) rose to 50.5% in March, indicating expansion for two consecutive months. Additionally, China’s GDP grew by 5.4% in Q1, exceeding market expectations.

Domestic Demand Provides a Safety Net

China’s robust domestic market is serving as a critical buffer against export uncertainties. In 2024, around 85% of export-oriented firms sold products domestically, with domestic sales making up about 75% of their total revenue. To facilitate this shift, the government and industry groups have streamlined regulations, while major retailers like JD.com have opened fast-track channels for foreign trade firms.

For example, Zhuhai-based Jindao Electrics, known for beauty appliances like hair straighteners and facial steamers, pivoted to the domestic market after a drop in U.S. orders. Partnering with JD.com, they developed strategies tailored to Chinese consumers. Chen Yu, head of JD’s beauty appliances business, noted, “We’ve provided guaranteed purchase agreements and integrated our platform’s traffic, marketing resources, and distribution channels to accelerate their domestic sales push.”

Exploring New International Markets

Beyond boosting domestic demand, Chinese exporters are actively diversifying into new global markets, particularly within the Global South. This strategic shift has reduced China’s reliance on the U.S. market, whose share of China’s total exports declined from 19.2% in 2018 to 14.7% in 2024.

Yueli Group, a leading manufacturer of hair dryers, exemplifies this trend. Since 2018, Yueli has decreased its U.S. sales to less than 20%, focusing instead on markets in Japan, South Korea, the Middle East, and Europe. By collaborating with local brands, Yueli creates high-quality, affordable products tailored to regional preferences. Marketing director Li Lizhong shared, “Over the past few years, we’ve seen consistent annual growth of over 30%. This has helped us effectively reduce the risks of relying too heavily on foreign markets.”

Resilience Reflected in Trade Infrastructure

China’s ports, barometers of foreign trade activity, highlight the resilience of its export sector. In the first quarter of 2025, port cargo throughput increased by 3.2% year-on-year. Domestic and foreign trade grew by 4.1% and 1.4% respectively, showcasing the strength of China’s dual circulation strategy, which emphasizes internal economic vitality alongside global engagement.

As global trade tensions continue, China’s focus on stimulating domestic demand and cultivating new international partnerships positions the country to maintain economic growth and stability.

Reference(s):

cgtn.com