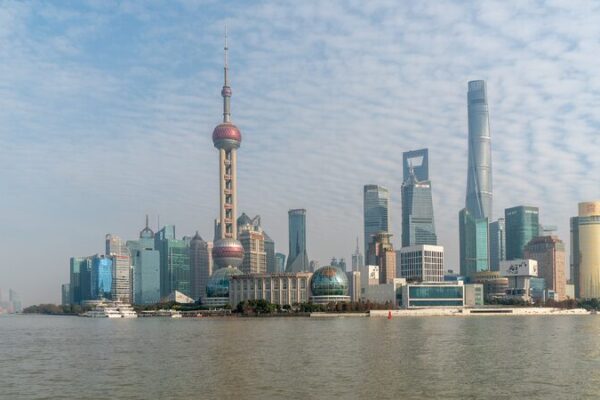

Despite rising global economic uncertainty, the Chinese mainland’s commitment to reform and opening-up continues to attract foreign investors. In the first quarter of 2025, the number of newly established foreign-invested enterprises increased by 4.3% year-on-year to 12,603, according to the Ministry of Commerce.

While foreign direct investment (FDI) inflows dipped to 269.23 billion yuan ($37.2 billion) in the first quarter, the decline slowed significantly. March showed a remarkable 13.2% year-on-year rebound in FDI, signaling renewed investor confidence.

Analysts attribute the overall dip in FI to external challenges, including heightened geopolitical tensions and US tariff hikes on Chinese goods. However, the recovery in March indicates that confidence in the Chinese mainland’s long-term market potential remains strong.

The focus on high-tech and innovation-driven sectors continues to draw foreign interest. Investment in e-commerce services surged by 100.5% in Q1, while biopharmaceuticals and aerospace equipment saw gains of 63.8% and 42.5%, respectively.

FDI sources are becoming more diverse, with investments from ASEAN nations rising 56.2%, EU inflows up 11.7%, and Switzerland and the UK seeing surges of over 60%, including investments routed through free ports.

A survey by the American Chamber of Commerce in South China revealed that 58% of foreign companies surveyed still consider the Chinese mainland one of their top three global investment destinations, reflecting confidence in the market’s resilience.

Foreign companies are also increasing their R&D investments, with firms like Sanofi, AstraZeneca, and Valeo expanding innovation hubs. They cite the country’s stable policy environment, high returns, and a thriving innovation landscape.

In response, the Chinese mainland is further opening up key service sectors. Siemens and other global firms have been approved for telecommunication trials, while the Ministry of Commerce has introduced 155 new measures to expand access to healthcare, tourism, and cross-border e-commerce.

The government is also streamlining market access, reducing the national negative list to just 29 items, making it easier for foreign enterprises to invest and operate.

Reference(s):

China sees strong foreign investment growth despite global uncertainty

cgtn.com