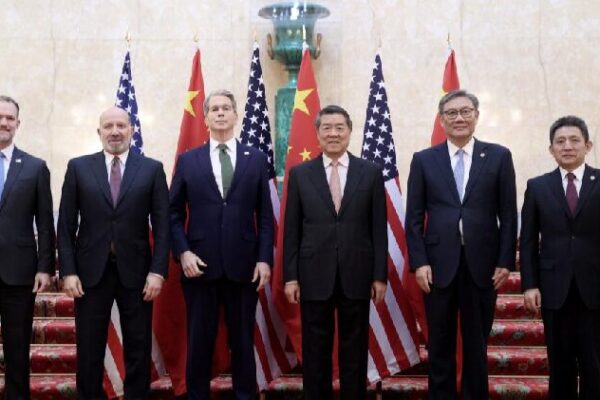

The recent China-U.S. economic and trade negotiations held in London have brought a glimmer of hope to global markets. While the talks resulted in a principled framework aimed at easing tensions, many questions remain about how this agreement will be implemented and what it means for the future of economic relations between the two nations.

Both sides emphasized a focus on consensus rather than detailing a specific agreement. This approach suggests that the negotiations were more about reducing immediate tensions than creating a long-term strategic plan. By managing immediate challenges and avoiding further escalation, China and the United States are buying time to address deeper disagreements.

Global markets reacted with cautious optimism following the talks. Asian stock markets saw an uptick, reflecting hope for improved relations. However, this optimism is tempered by ongoing uncertainties. Economists predict continued volatility, indicating that fluctuations in China-U.S. relations will heavily influence the global economic landscape. Businesses and investors are encouraged to build greater strategic agility and resilience, preparing for longer periods of instability.

In the long term, one significant obstacle remains: the push from some U.S. policymakers to reduce economic interdependence with China. While a complete economic decoupling is unlikely, efforts to diversify supply chains are reshaping global trade dynamics. Many U.S. companies are seeking to reduce dependence on Chinese manufacturing but recognize that China’s extensive supply chains are difficult to replicate elsewhere.

Despite geopolitical tensions, many U.S. businesses remain committed to the Chinese market. Their primary concern lies with policy unpredictability. There is a growing demand for institutionalized dialogue and a stable, predictable policy environment. To mitigate external shocks, companies are focusing on local operations and diversification within China.

Additionally, recent global events have exposed vulnerabilities in supply chains, prompting policymakers to reconsider dependencies on key products like medical supplies, semiconductors, and rare earths. Even if tariffs are reduced in the future, efforts to promote domestic production or invest in allied countries are likely to continue. This structural shift means that businesses must prepare for higher costs and fragmented supply chains moving forward.

Another challenge is the ongoing disputes over critical technologies. Issues surrounding rare earths and semiconductors highlight the complexities of economic interdependence. National security concerns are increasingly influencing trade relations, leading to zero-sum technological competition. This division in the technological ecosystem may force other countries to navigate between competing standards and supply chains, potentially increasing costs and reducing efficiency.

As China and the United States navigate this complex landscape, the world watches closely. The outcomes of their economic and trade relations will have far-reaching implications for global markets and international relations. Businesses, investors, and governments alike must stay informed and adapt to the evolving dynamics between these two economic giants.

Reference(s):

What's next for China-U.S. trade relations after the London talks?

cgtn.com