Why We Should Be Excited About China’s Growing Unicorns

China is witnessing a surge in unicorn companies—startups valued at over $1 billion—and there’s good reason to be optimistic. The government’s recent plans aim to support these innovative businesses, especially small and medium-sized enterprises (SMEs) that specialize in unique and cutting-edge technologies.

China’s Unicorn Landscape

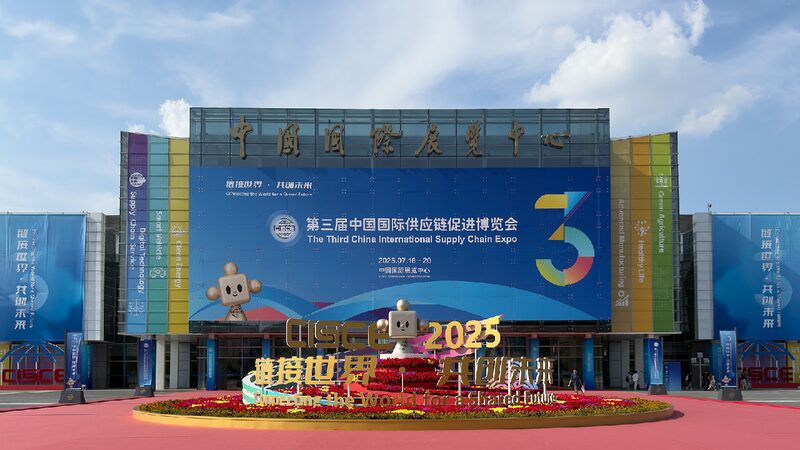

According to the 2024 Global Unicorn Index by the Hurun Research Institute, China ranks second in the world with 340 unicorns, just behind the United States. While the global average growth rate of unicorns is 14.9%, China’s unicorns grew at an average rate of 8.3%. However, the number of state-owned unicorns in China has significantly increased, rising from fewer than nine in 2020 to over 20 in 2024. These state-owned enterprises are crucial for strengthening China’s supply chain and industrial security.

Valuation and Public Offerings

Chinese unicorns have an average valuation growth rate of 19.3%, slightly higher than the global average. In 2024, China led the world in unicorn companies going public, with 18 out of 29 global unicorn IPOs. Many potential unicorns, like “single champions” and “little giants”—companies specializing in niche sectors—have chosen to go public, particularly on China’s Science and Technology Innovation Board (STAR Market). By the end of 2024, the STAR Market had 581 listed companies with a total market value exceeding 6.34 trillion yuan (about $881.9 billion), and 370 of these companies meet the unicorn valuation threshold.

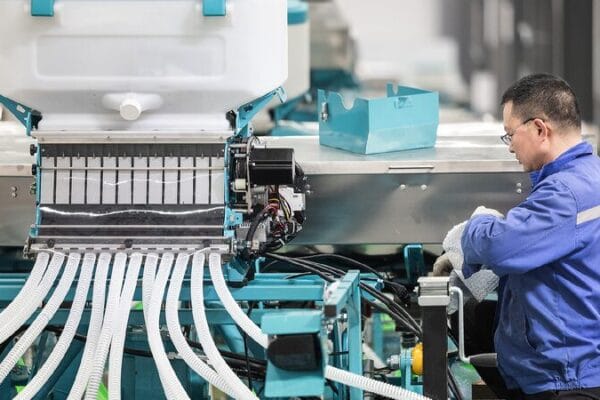

Leading Industries

The top sectors for Chinese unicorns are artificial intelligence (AI), semiconductors, and green energy. The AI sector, in particular, has seen rapid growth. The number of Chinese AI unicorns increased from 18 in 2019 to 37 in 2024, making up 40% of global AI unicorns. As of June 2024, China had over 4,500 AI companies, with the core sector valued at nearly 600 billion yuan. Generative AI is being widely applied in content creation, business operations, technological research, and industrial production.

Challenges Ahead

Despite these successes, Chinese unicorns face challenges such as difficulties in securing financing, slower growth rates, and reduced technological exchanges due to international restrictions. These issues can hinder sustained innovation and rapid development.

The Path Forward

To bolster unicorn growth, it’s important to prioritize resource allocation and enhance supportive policies. The government can establish specialized institutions to foster innovation among small enterprises, building a robust support system for SMEs and aiding the incubation of unicorns. Additionally, leveraging the capabilities of state-owned investment companies, industrial funds, and venture capital can provide more opportunities for capital investment and expansion. Encouraging strategic investments and acquisitions aimed at unicorn enterprises will create new avenues for growth in this emerging sector.

With the right support and strategies, China’s unicorn companies have the potential to drive significant innovation and economic growth in the coming years.

Reference(s):

cgtn.com