Global markets are reeling after a dramatic selloff on Wall Street, highlighting the far-reaching consequences of protectionist trade policies. On March 10, the Dow Jones Industrial Average plunged 890 points, while the S&P 500 and Nasdaq tumbled sharply, erasing months of gains.

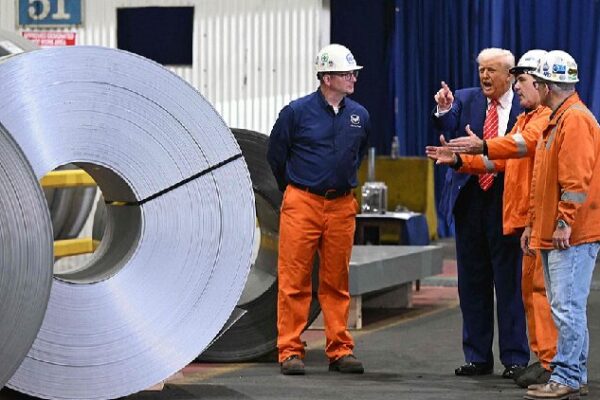

The primary catalyst? Unpredictable U.S. tariffs that have unsettled investors worldwide. The U.S. administration’s decision to impose hefty tariffs on imports—from Chinese goods to steel and aluminum—has sparked fears of a trade war, causing markets to become increasingly volatile.

Investors Fear Uncertainty

Financial markets thrive on stability, but recent trade policies have introduced significant uncertainty. The increased tariffs on imports not only strain relations with key trading partners but also disrupt global supply chains. Businesses are grappling with higher costs for materials, leading to squeezed profits and cautious investment strategies.

Tech giants like Apple, Microsoft, and Amazon have seen significant drops in their stock values. Even companies that were riding high on technological advancements, such as Nvidia and Palantir, have experienced sharp declines. This shift indicates a broader concern among investors about the future of the global economy.

Signs of a Slowing Economy

Beyond the stock market, other economic indicators are flashing warning signs. Layoffs are increasing, hiring has slowed, and consumer confidence is waning. The yield on the 10-year U.S. Treasury bond has dropped as investors seek safer assets, a classic signal of market distress.

The airline industry is also feeling the impact. Major carriers have slashed profit forecasts, citing economic uncertainty and higher operational costs due to tariffs. These developments point to a potential slowdown in economic growth, with some experts warning of a possible recession.

The Global Ripple Effect

The repercussions of U.S. trade policies aren’t confined to its borders. Emerging markets in the Global South are particularly vulnerable to shifts in global trade dynamics. As the world’s economies are interconnected, volatility in one major market can lead to instability elsewhere.

For young people in these regions, economic instability can have significant consequences, affecting job prospects and economic opportunities. The market meltdown serves as a reminder of how interconnected our world is and how policies in one country can impact lives globally.

Looking Ahead

The current situation underscores the importance of thoughtful trade policies that consider global implications. As markets continue to react to policy decisions, there is a growing call for strategies that promote stability and cooperation rather than uncertainty and division.

Conclusion

The market turmoil sparked by U.S. tariffs highlights the delicate balance of the global economy. It serves as a crucial lesson on how protectionist measures can have unintended and far-reaching consequences. For investors, businesses, and young people worldwide, the hope is for a move toward policies that foster economic growth and stability.

Reference(s):

U.S. tariff trap: How protectionism sparked a market meltdown

cgtn.com