China has just rolled out an exciting new plan to boost consumer spending and bring stability to its stock and real estate markets. Announced on Sunday, this strategy marks a big shift in how the country aims to strengthen its economy by focusing not just on what’s being produced but also on what people are buying.

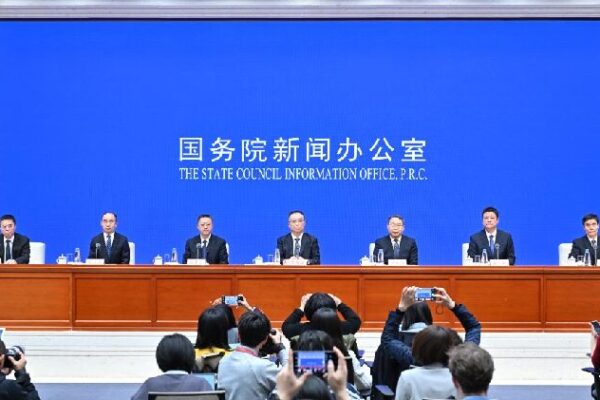

For the first time, China is emphasizing the importance of stabilizing the stock and real estate markets to encourage people to spend more, according to Li Chunlin, deputy director of the National Development and Reform Commission. “We’re introducing measures to boost consumer confidence and stabilize expectations,” Li said on Monday.

In the past, policies mainly targeted the supply side, working on the idea that producing more would naturally lead to more buying. But now, the focus is shifting towards putting more money in people’s pockets and making life more affordable. “We’re prioritizing reasonable wage growth and scientifically adjusting minimum wages,” Li explained, highlighting key parts of the new plan.

To help people earn more from their property investments, the plan includes steps like stabilizing the stock market and making it easier for big funds—like commercial insurance and pension funds—to invest. This could open up new opportunities for long-term growth and stability.

When it comes to housing, the plan aims to stop the current downturn and bring back stability to the real estate market. By better meeting people’s housing needs, China hopes to revive this important industry and provide a strong base for the economy.

This comprehensive strategy shows China’s commitment to adapting to new challenges, aiming to support sustainable growth and improve the well-being of its people.

Reference(s):

China's new policies help stabilize stock and real estate markets

cgtn.com