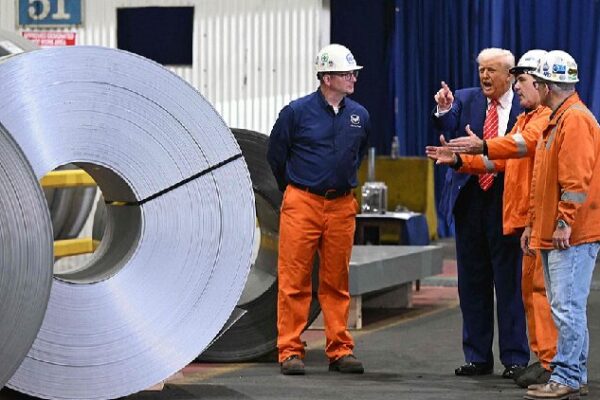

The U.S. is bracing for a potential trade war as President Donald Trump moves forward with plans to impose hefty tariffs on imports from Canada, Mexico, and the European Union. On Friday, Trump announced that starting February 1, a 25% tariff will be applied to key imports including chips, oil and gas, steel, and aluminum.

Speaking to reporters, Trump hinted at the possibility of broader tariffs on oil and natural gas imports from Canada, set to be introduced in mid-February. While crude oil imports from Canada might face a slightly lower tariff rate of 10%, the news has already caused oil prices to surge.

The prospect of sweeping tariffs has not gone unnoticed by the U.S.’s trading partners. Canadian Prime Minister Justin Trudeau expressed his country’s readiness to respond with “purposeful, forceful but reasonable, immediate” countermeasures. Canada, being the largest supplier of U.S. energy imports, has considerable leverage. The Canadian government is considering tariffs on U.S. products, such as Florida orange juice, and is prepared to target up to C$150 billion worth of U.S. imports.

Mexico is also gearing up for retaliation. Mexican President Claudia Sheinbaum stated that Mexico has “Plan A, Plan B, Plan C” depending on the U.S. actions. She emphasized that Trump’s tariffs could cost 400,000 U.S. jobs and increase prices for American consumers.

Economists warn that these tariffs could disrupt global economic activity. The International Monetary Fund’s chief economist, Pierre-Olivier Gourinchas, noted that such policies are likely to push inflation higher in the near term. The ripple effect could see increased prices for everyday goods, from groceries to electronics.

Business leaders share these concerns. Matthew Holmes, public policy chief at the Canadian Chamber of Commerce, remarked, “President Trump’s tariffs will tax America first.” He highlighted that higher costs will impact consumers and businesses on both sides of the border.

Liu Ying, a researcher at the Chongyang Institute for Financial Studies at Renmin University of China, pointed out that higher tariffs could increase import costs for the U.S., potentially pushing inflation up to 3%. She warned that this could alter the Federal Reserve’s interest rate policies and lead to a realignment of global trade patterns.

As the February deadlines approach, the world watches anxiously. The potential for a trade war raises concerns about volatile financial markets and disruptions to global supply chains. It’s a developing story that could have far-reaching implications, especially for economies in the Global South that are closely tied to global trade dynamics.

Reference(s):

Retaliation, inflation, disruption: What to take from Trump tariffs?

cgtn.com