The United States has announced a 10-percent tariff on imports from the Chinese mainland, citing concerns over fentanyl and other issues. In response, China has filed a case with the World Trade Organization (WTO) and is imposing retaliatory tariffs on American goods.

China’s Ministry of Commerce condemned the U.S. move, calling it a violation of WTO rules and an act of unilateral trade protectionism. Starting February 10, the State Council Tariff Commission will implement new duties, including a 15-percent tariff on coal and liquefied natural gas, and a 10-percent tariff on crude oil, agricultural machinery, large-displacement vehicles, and pickup trucks.

Impact on Major Industries

Despite growing trade barriers, China’s exports to the U.S. remain substantial. In 2024, total exports reached approximately $524.7 billion, with electrical machinery, textiles, base metals, plastics, and transport equipment among the top categories. These industries are expected to feel the biggest impact from the renewed tariff dispute.

Economic Consequences of Tariffs

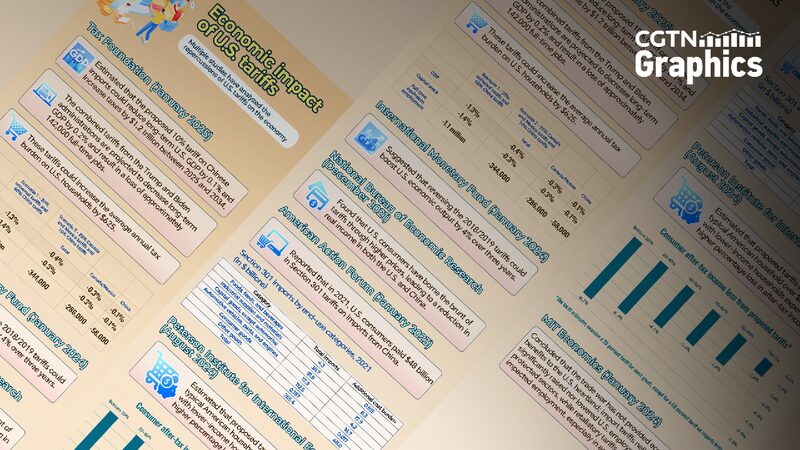

Multiple studies suggest that tariffs have largely hurt the U.S. economy. Research indicates that the tariff policies have driven up costs for consumers and businesses, reduced economic output and employment, and led to broader economic strain.

A study by the Tax Foundation estimates that these tariffs could reduce long-term U.S. GDP by 0.2 percent, decrease capital investment by 0.1 percent, and eliminate 142,000 jobs. Meanwhile, the International Monetary Fund projected that repealing the 2018-2019 tariffs could boost U.S. output by 4 percent over three years.

Why Is Trump Pushing for More Tariffs?

Former President Trump argues that tariffs will boost federal revenue. “We will take in hundreds of billions of dollars into our treasury and use that money to benefit the American citizens,” he stated. He also claims tariffs will enhance American manufacturers’ competitiveness and create jobs.

However, most economists dispute these claims, warning that tariffs function as a hidden tax on American consumers and businesses. Additionally, Trump sees tariffs as a powerful negotiation tool. For example, on January 26, after Colombian President Gustavo Petro refused to allow U.S. military planes carrying deportees to land in Colombia, Trump announced a 25-percent tariff on Colombian goods. He later rescinded the decision after reaching an agreement.

It’s important to note that while tariffs may increase federal revenue, the tax burden is imposed on U.S. consumers. High tariffs can also suppress import volumes, reducing the tax base over time.

The Bigger Picture

The renewed trade tensions between the U.S. and China are causing uncertainty in the global economy. As both nations impose tariffs, industries and consumers on both sides may face higher costs and reduced access to goods.

The question remains: Who is really paying the price of this trade war? As the situation unfolds, global markets and economies will be closely watching the outcomes of these policies.

Reference(s):

cgtn.com