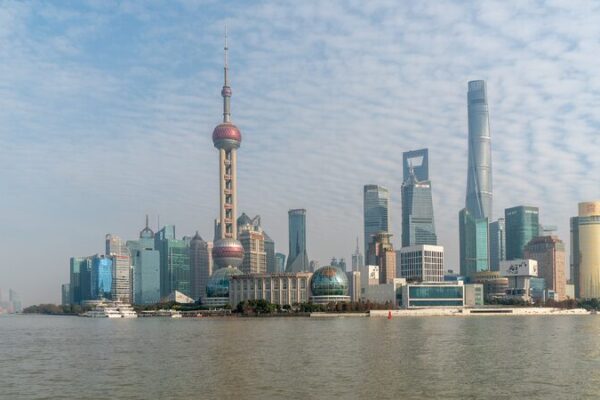

As global trade tensions simmer, investors around the world are turning their attention to Asian markets. With currencies appreciating and earnings on the rise, Asia is becoming a hotspot for global capital.

Since February, currencies like the Chinese yuan and the Indian rupee have gained significant value, rising by 2.4% and 2.3% respectively. This appreciation is drawing in foreign investors, as stronger currencies often signal increased capital inflows.

According to Manishi Raychaudhuri, founder and CEO of Emmer Capital Partners Ltd., “With fundamentals in many Asian markets now appearing to turn around—driven by positive trends in China and improved consumption in South Asia—we could soon see an inflection point.”

Analysts suggest that growing confidence in China’s economic prospects, alongside recent stimulus measures, is attracting global investors seeking opportunities beyond developed markets. In fact, 45% of investors viewed China’s economic rebound as the biggest upside factor in the emerging-market outlook, up from 29% in the previous survey, according to HSBC’s Emerging Markets Sentiment Survey for March.

Meanwhile, Japan’s yen is gaining attention as a safe-haven asset. Goldman Sachs expects the yen to climb to the low 140 levels against the dollar this year, as concerns over US growth and trade tariffs increase demand for safer investments.

Despite ongoing trade disputes and geopolitical risks, Asia’s improving fundamentals and supportive policy measures make it an increasingly attractive destination for global capital. For young investors and businesses in the Global South, this shift could present new opportunities for growth and collaboration.

Reference(s):

Global investors shift to Asia amid currency gains, earnings boost

cgtn.com