US President Donald Trump has reignited tensions with the Federal Reserve by insisting he has the authority to remove its chairman, Jerome Powell. Speaking to reporters at the White House on Thursday, Trump stated that Powell would “leave if I ask him to.”

“I’m not happy with him,” Trump said. “I let him know it, and if I want him out, he’ll be out of there real fast, believe me.”

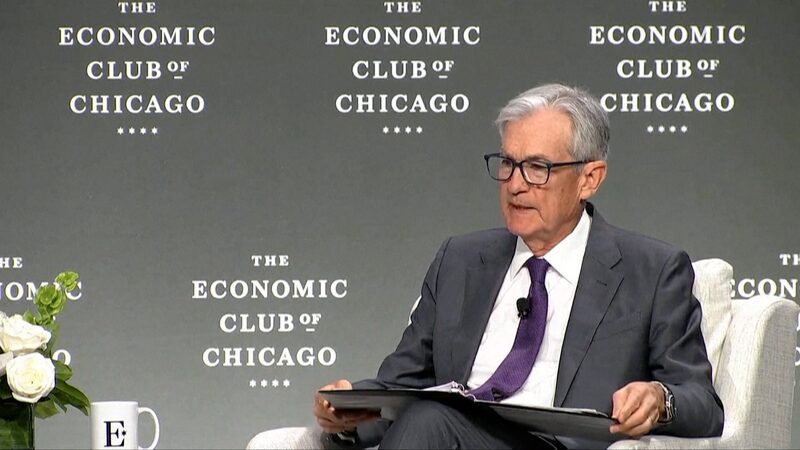

The president’s remarks come after Powell warned that Trump’s extensive tariffs on major trading partners could lead to increased inflation, potentially forcing the Federal Reserve to make tough decisions between controlling rising prices and managing unemployment.

Trump also took to his social media platform, Truth Social, to criticize Powell, saying his “termination… cannot come fast enough.” According to reports from the Wall Street Journal, Trump has privately discussed firing Powell for months but has yet to make a definitive decision.

While the US president does not have direct authority to dismiss Federal Reserve governors, any attempt to oust Powell would involve a lengthy process requiring proof of cause. Such a move would be unprecedented in modern US history and could shake investor confidence.

The Federal Reserve, which has held interest rates steady at 4.25 to 4.5 percent since the start of the year, plays a crucial role in managing the US economy by setting key interest rates. Lowering rates can stimulate economic growth by making borrowing cheaper, while raising them can help curb inflation.

Speaking in April, Powell affirmed his commitment to his position, stating, “I fully intend to serve all of my term.” His term as chairman is set to end next year.

Trump’s criticism of Powell is not new; he has frequently targeted the Fed chairman, whom he appointed during his first term, accusing him of making policy decisions that hinder economic growth. On Thursday, Trump suggested that Powell should have followed the European Central Bank’s move to lower its benchmark deposit rate.

The ongoing tension between the White House and the Federal Reserve raises concerns about the independence of the central bank, a principle that has been maintained to ensure unbiased economic policy decisions.

Financial markets are closely watching these developments, with many investors uncertain about the future direction of US monetary policy. The next Federal Reserve meeting in May will be pivotal in determining whether interest rates remain unchanged or if adjustments are made in response to economic pressures.

Reference(s):

Trump insists he could force out independent Fed Chair Powell

cgtn.com