Analysts are calling on China to ramp up its spending to keep the world’s second-largest economy growing strong. Despite a better-than-expected performance in the first half of 2025, experts say more fiscal stimulus is needed to boost domestic demand in the face of ongoing trade tensions with the United States.

China’s industrial production has been a key driver of growth, with major industrial firms increasing their output at a faster pace than the overall economy. Exports have also shown resilience, growing by an average of 6.2% in the second quarter, up from 5.1% in the first quarter. This uptick is credited to Chinese companies adapting to U.S. tariff pressures, according to a report by the China Finance 40 Forum (CF40).

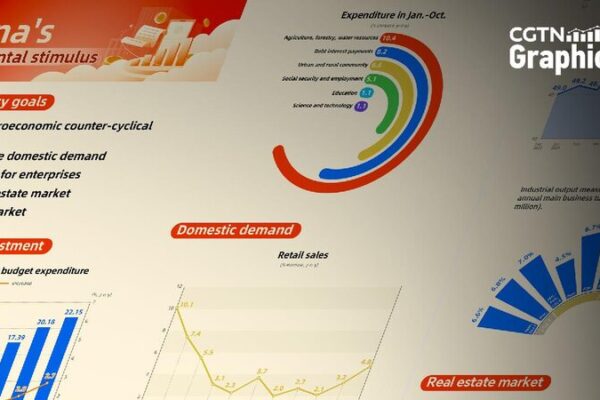

Domestic consumption is picking up, too. Retail sales have accelerated, thanks in part to government-supported “trade-in” programs that encourage consumers to replace old products with new ones. However, experts warn that these positive trends might not be enough to sustain growth without additional support.

“Expanding domestic demand should remain a top priority,” says Zhang Bin, a senior fellow at CF40 and deputy director at the Institute of World Economics and Politics at the Chinese Academy of Social Sciences. Zhang outlines four key recommendations to bolster the economy in the second half of the year.

First, he suggests that the government should issue an additional 2.3 trillion yuan ($320 billion) in bonds to expand fiscal spending and meet budget targets. This move would provide the necessary financial backing for continued economic growth.

Second, Zhang recommends increasing public investment in urban renewal projects. With manufacturing investment slowing down, these projects could become new engines for growth and help sustain domestic demand.

Third, he advocates for further cuts to policy interest rates. Lowering borrowing costs would stimulate private-sector demand by making it cheaper for businesses and individuals to take out loans.

Finally, Zhang proposes a dual-track approach to stabilize the property market. This includes easing home-buying restrictions to boost demand and accelerating debt restructuring for developers on the supply side.

While China’s economy has shown resilience, uncertainties like U.S. tariffs and fiscal constraints pose challenges. Government debt issuance has already surged to 6.3 trillion yuan ($880 billion) from January to May, far exceeding the 2.5 trillion yuan issued during the same period in 2024. With issuance capacity for the rest of the year projected at 7.6 trillion yuan—below last year’s levels—there’s limited room for additional spending without policy adjustments.

As the second half of 2025 unfolds, all eyes are on China’s policymakers to see how they will navigate these challenges and keep the economy on its growth trajectory.

Reference(s):

Experts call for stronger fiscal stimulus to sustain China's growth

cgtn.com